1099-MISC Template

- 9 January 2024

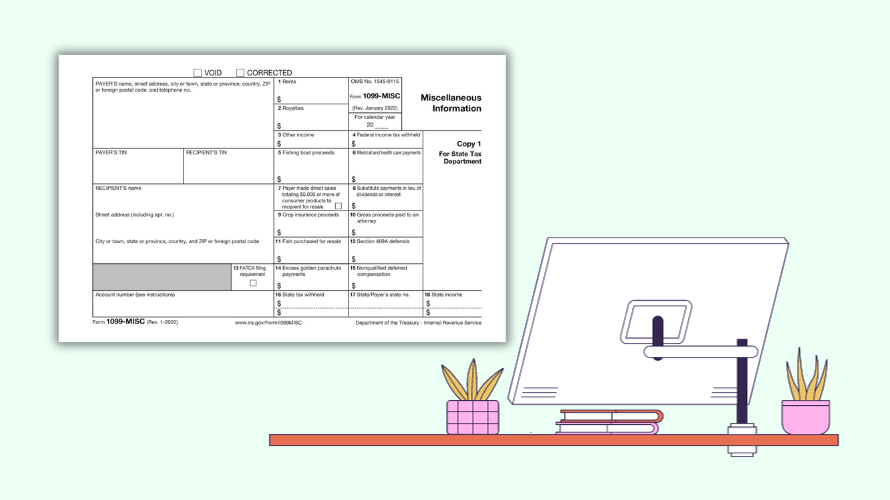

For individuals and businesses navigating the complexities of tax reporting, Form 1099-MISC is a crucial document that reports certain types of income outside regular employment wages. This form is typically used to report payments made to independent contractors, rental property income, prizes, awards, and other miscellaneous incomes. The IRS requires that businesses issue a 1099-MISC to any individual or entity they’ve paid at least $600 in services, rents, awards, and other income payments during the tax year.

If you're looking for the convenience of a download option, you can access a 1099 template for download directly from our platform. With these resources at your fingertips, managing your tax reporting responsibilities efficiently becomes far more achievable.

Features of Fillable Form 1099-MISC

When preparing to file Form 1099-MISC, utilizing a fillable template can streamline the process. A 1099 fillable template is designed to simplify data entry and reduce errors. These digital versions often include interactive fields where you can type information directly onto the form, which can then be printed or submitted electronically. Automatic calculations and validation checks are also features commonly integrated into fillable forms to ensure accuracy in reporting. Accessibility is another benefit - fillable versions can be easily obtained from credible sources online, including tax software providers and our website itself.

Potential Challenges with the 1099-MISC Online Filing

Filing the online 1099-MISC template for free might be convenient, but it comes with its own set of challenges. One of the main difficulties is ensuring the security and privacy of sensitive information. Moreover, navigating digital platforms can be daunting for those who are not tech-savvy. To avoid these issues, it's important to use reputable services. Additionally, there may be various electronic filing requirements and formats to follow depending on the system you're using, so it's essential to familiarize yourself with those specifications before submitting your forms.

Guidelines for Completing Tax Form 1099-MISC

When setting out to print the 1099 form template and complete it successfully, follow these key rules:

- Deadlines

Ensure you meet the IRS deadlines for submitting 1099 forms to avoid penalties. Typically, the form must be provided to the recipient by January 31st and filed with the IRS by the end of February (if filing on paper) or by the end of March (if filing electronically). - Accuracy

Double-check all the information you include on the form, such as Taxpayer Identification Numbers (TIN), payment amounts, and recipient details. Errors can lead to fines and delay the filing process. - Software Compatibility

If you are e-filing, make sure that your tax software supports the electronic submission of Form 1099-MISC. It's crucial to check software updates and compatibility each tax season. - State Requirements

Some states have additional criteria for reporting income using Form 1099-MISC, so be sure to research your specific state’s requirements as well.

To assist you with meeting these rules, a 1099 printable template is a readily available option that can be particularly useful. Templates ensure that you have the correct format for manual submission or for your records before you transfer the details onto an electronic system for e-filing.